US Secondary Data Center Market Trends

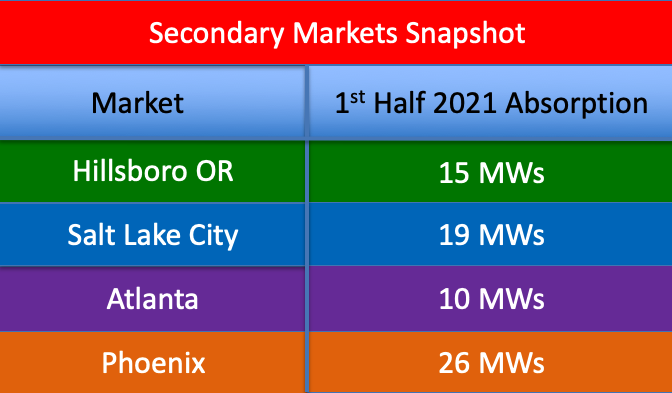

With certain exceptions, secondary data center markets have experienced tepid growth while the major data center markets have experienced record breaking new development and absorption over the past several years. Secondary markets such as Atlanta, Salt Lake City, Phoenix and Hillsboro are witnessing significant new data center projects due to broader government tax incentives, low cost of power, land affordability, and more robust, low latency fiber solutions.

Overall, the data center market is geographically spreading out as more operators are pushing into the secondary markets and getting closer to the end consumer. Historically, most of the attention and investment has been focused on the major data center markets including Northern Virginia, Silicon Valley, Dallas and Chicago. As more development has occurred in the major markets, land pricing has become very expensive, incentives have been challenged and power availability has become constrained.

With improving low latency fiber networks across the US, data center operators and hyperscalers have more options to provide high quality services to end users in secondary markets. A push to the “edge” is now being executed by operators seeking scaled-down footprints in lower cost, secondary business hubs.

While the major markets will continue to expand, secondary markets are starting to see new developments and absorption not seen in the past. During the first half of 2021, Phoenix witnessed 26 MWs of absorption and Salt Lake City saw 19 MWs of absorption. Historically a retail colocation market with limited activity, Atlanta has seen 10 MWs of absorption so far in 2021 and significant new data center developments of an estimated 30 MWs are underway.

Expect to see the trend continue as operators and hyperscalers seek to provide their data center solutions in underserved markets.