Five 9s Digital: Insights Into CME's Data Center Sale-Leaseback To CyrusOne

Summary

One of the challenges facing every enterprise CTO is how to evaluate future data center needs in light of today's hybrid IT world.

CME Group's degree of difficulty was magnified by its data center supporting key customers colocated in the same facility.

Here is a unique perspective from industry experts at Five 9s Digital who assisted in structuring one of the largest data center sale-leaseback transactions of 2016.

The $130 million sale-leaseback transaction between CME Group (NYSE: CME) and CyrusOne (NASDAQ: CONE) back in March was one of the largest and most complex data center transactions of 2016. The CME Globex electronic trading platform supported over 3.5 billion transactions in 2015, with an aggregate value greater than one thousand trillion dollars. Additionally, some of CME Group's most valuable customers and trading counterparties are colocated within this facility.

As part of the transaction, the 428,000-square foot CME Globex data center located in Aurora, Illinois, also came with a 15-acre vacant land parcel entitled for future expansion. CyrusOne has subsequently announced that it will build a massive data center on this site adjacent to the existing facility.

This sale-leaseback was actually the culmination of a multi-year effort, according to long-time CME Group COO Julie Holzrichter. Holzrichter was a featured speaker at CyrusOne's Investor Day, held in New York one week after the 15-year sale-leaseback deal was publicly announced. She focused on the rigorous vetting process which led her team to select CyrusOne as the "only logical choice" to become the future CME landlord and operating partner.

Achieving that milestone naturally led to the next phase of this transaction, i.e., working through the list of complex issues required to reach a definitive agreement to sell any corporate data center.

Helping To Structure a Win-Win

CME Group decided in the summer of 2015 to engage Charlotte-based Five 9s Digital as a consultant to help analyze and structure a sale-partial leaseback transaction.

Initially, Five 9s provided CME Group a comprehensive assessment of the data center in order to provide a baseline valuation and understanding of what it was selling. The scope of work for Five 9s included: taking into account re-purposing of existing technical infrastructure, performing sale/leaseback transaction comparisons (utilizing regional and national market data), financial analyses, as well as helping to educate internal stakeholders on transaction mechanics.

According to Five 9s principal, Doug Hollidge:

"There are a number of qualified folks in the data center marketplace with focus on specific segments of the data center arena which may include brokers, SLA consultants and legal counsel. However, very few companies can provide a full-scope analysis of a company's current situation, create a menu of available options, provide detailed financial analyses of the solutions and push the process to a successful resolution."

Meanwhile, CME Group customers were seeking efficient alternatives for their computing and data requirements in Aurora, greater cost efficiencies, and flexibility to shift toward cloud and shared infrastructure IT solutions.

Cloud and Connectivity Mattered

CME Group customers seek to monetize global information from sources such as NOAA, North Sea weather forecasts, and even social media platforms in order to improve trading outcomes.

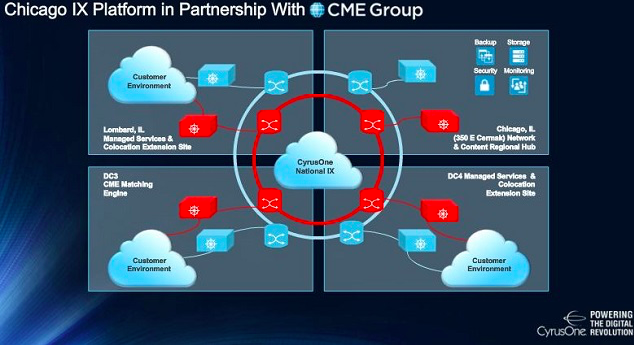

Source: CyrusOne - Investor Day 2016 presentation

A comprehensive solution was co-created utilizing CyrusOne's National IX to provide interconnection and cloud access to CME Group customers.

The CME Globex data center in Aurora is tethered to the iconic 350 E. Cermack in downtown Chicago, a premier connectivity hub for the Midwest. CME's colocation customers gain direct access to Amazon Web Services, multiple cloud and IT service providers, and numerous peering opportunities.

CyrusOne provides additional offerings in Aurora, such as Disaster Recovery, Infrastructure-as-a-Service, as well as access to a robust financial ecosystem in New York and an extensive energy sector customer base in Texas.

A Difficult Assignment

What is a fair price for the data center, and what is a fair price for the leaseback terms?

Conversion of a corporate-designed data center to a multi-tenant facility can require redesign and substantial capital necessary to repurpose a facility to meet today's technology standards. Helping to identify and quantify these projected expenses and redesign components is a crucial part of the process leading to the execution of a final contract - and ultimately, the closing of the transaction.

Management teams which are proactive and decisive regarding an overbuilt facility stand to achieve better results with a sale-leaseback transaction than peers that "kick the can down the road." The longer an enterprise waits to decide about corporate-owned data centers, the more likely industry trends will make developing ground-up facilities more attractive to third-party operators.

While time is of the essence, there is still a need to educate internal corporate stakeholders on the transaction mechanics and industry standards. Five 9s helped to coordinate between legal, IT, and operations to provide C-Suite decision makers with alternatives and assist with final negotiations.

Transaction Advantages

The 428,000-square foot CME Globex data center was originally put into service in 2009 and was a state-of-the-art facility. This infrastructure, which supports electronic trading worldwide, is crucial for both CME and its valuable customer base.

Data center design and IT architectures have continued to evolve, allowing enterprise customers to do more with less space. Many corporate data centers were designed prior to the cloud computing paradigm shift and virtualization of servers. This can create "stranded capacity" in a corporate data center, where underutilized equipment still must be operated, maintained, upgraded, and replaced over time.

The sale of CME's mission-critical data center solves many of these issues. CME was able to lease the amount of space needed and contract for necessary levels of service with CyrusOne, while retaining control of the environment and security protocols. CME retained flexibility to expand as needed, with a trusted operating partner responsible for maintaining the data center and its operations.

Simultaneously, CyrusOne was able to acquire a first-class data center campus, inclusive of substantial infrastructure, anchored by CME Group leasing back 10 MW of capacity on a long-term lease. It was able to attain superior risk-adjusted returns versus the cost of buying and entitling land for development and obtaining necessary utility power for a large facility with suitable fiber connectivity in the Chicago market.

Bottom Line

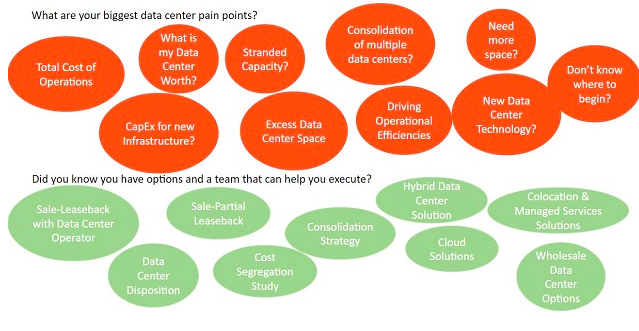

All larger enterprises are somewhere along the path of evaluating a distributed, hybrid IT architecture - which can become a daunting process, beyond the scope of existing corporate resources.

Many legacy data centers have historically been viewed as corporate crown jewels. However, data centers can age out of being functional for a conversion to a multi-tenant facility. A tremendous amount of capital is tied up in the lifespan of the facilities, despite the fact that maintaining and operating data centers is not a core business focus of the company.

The decision to consider a sale or sale-leaseback always involves multiple stakeholders with various outlooks relating to a company's long-term data center solutions.

A qualified consultant can help assist the CIO and/or CTO understand and weigh various options available in today's rapidly transitioning data center solutions marketplace. This enables the team tasked with the data center evaluation to present viable total cost of ownership choices to the CFO, while addressing concerns of other stakeholders.

Source: Five 9s Digital

Data center solutions also are a hot topic for small and medium-sized enterprises which have similar needs. However, with the availability of third-party options such as colocation, managed services and cloud solutions, the SMB market has the opportunity to bypass the entire corporate-owned data center cycle.

"There are many cost savings opportunities available," according to Five 9s Digital Principal Steve Bollier, "we can help clients break down their existing and future data center requirements, identify an optimal solution, and streamline the implementation process."

Key Takeaways

CyrusOne was able to gain an immediate presence and customer ecosystem in the metro Chicago data center market. The same data center located in a more remote location would have been much more difficult a deal to structure.

Clearly, time is of the essence for enterprise CTOs looking to monetize facilities, as the pace of development of purpose-built multi-tenant data centers continues to accelerate in both primary and secondary US markets.

This transaction illuminates the difficulty facing publicly traded data center REITs when it comes to balancing the "lumpy" aspect of signing large wholesale enterprise lease deals, while being tasked with reporting earnings every three months.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.